Overview

Real estate definitions encompass land and any permanent structures, categorized into residential, commercial, industrial, and agricultural types, which significantly influence asset values and investment strategies. The article emphasizes the importance of understanding these classifications, as they affect legal and financial implications, market trends, and investment decisions, underscoring the necessity for informed engagement in the real estate sector.

Introduction

In the intricate realm of real estate, a comprehensive understanding of its foundational concepts is essential for navigating the complexities of property ownership and investment. Real estate, defined broadly, encompasses land and the permanent structures affixed to it, with classifications ranging from residential to commercial and industrial. Each category presents unique characteristics, market dynamics, and legal implications that significantly influence investment strategies and property valuations.

As the market evolves, particularly in 2024, trends such as rising rental costs and shifting consumer preferences underscore the importance of informed decision-making. High-quality visual tools, such as 3D exterior renderings, emerge as vital assets in bridging the gap between conceptualization and realization, aiding architects and investors alike in making strategic choices that align with market demands.

Understanding these multifaceted elements not only enhances investment acumen but also ensures that stakeholders remain adept in a rapidly changing landscape.

Defining Real Estate: An Overview of Key Concepts

The real estate definition includes land and any permanent structures or improvements affixed to it, such as buildings, residential homes, and various types of infrastructure. This sector represents a wide spectrum of real estate types, which is often explained by the real estate definition that categorizes them into classifications such as residential, commercial, industrial, and agricultural. Comprehending the real estate definition and its classifications is essential, as these significantly affect asset values and investment strategies.

As articulated by J.R. Russell, head of direct-to-consumer mortgage lending at Citi Mortgages, ‘Don’t put pressure on yourself to make any potentially hasty decisions on what may be your biggest asset and the largest financial decision of your life.’ This viewpoint emphasizes the significance of being well-informed about the rights and interests associated with property ownership, as variations in legal and financial implications can arise depending on the property’s classification and intended use. Recent trends in the 2024 property market further highlight the importance of comprehending these dynamics.

For instance, Hawaii has the highest average monthly rental costs at $2,423, highlighting significant market pressures. Additionally, rent concessions have increased year-over-year in 41 of the 50 largest metro areas, with notable spikes observed in cities like Charlotte and Raleigh. Such trends reflect the evolving landscape of real estate definition and underline the importance of high-quality 3D exterior renderings as a vital communication tool between homeowners and builders.

These renderings not only showcase natural lighting, landscaping, and building materials for contextual visualization but also play a crucial role in strategic planning for architects and investors in response to market pressures. The essential role of these visual renderings in project development and decision-making cannot be overstated, as they engage clients and clarify project specifications, ultimately supporting informed investment choices. Moreover, understanding the real estate definition and how different classifications of assets can influence the approach to renderings enhances their effectiveness as a marketing tool, ensuring that the visual representation aligns with the specific needs and expectations of various stakeholders.

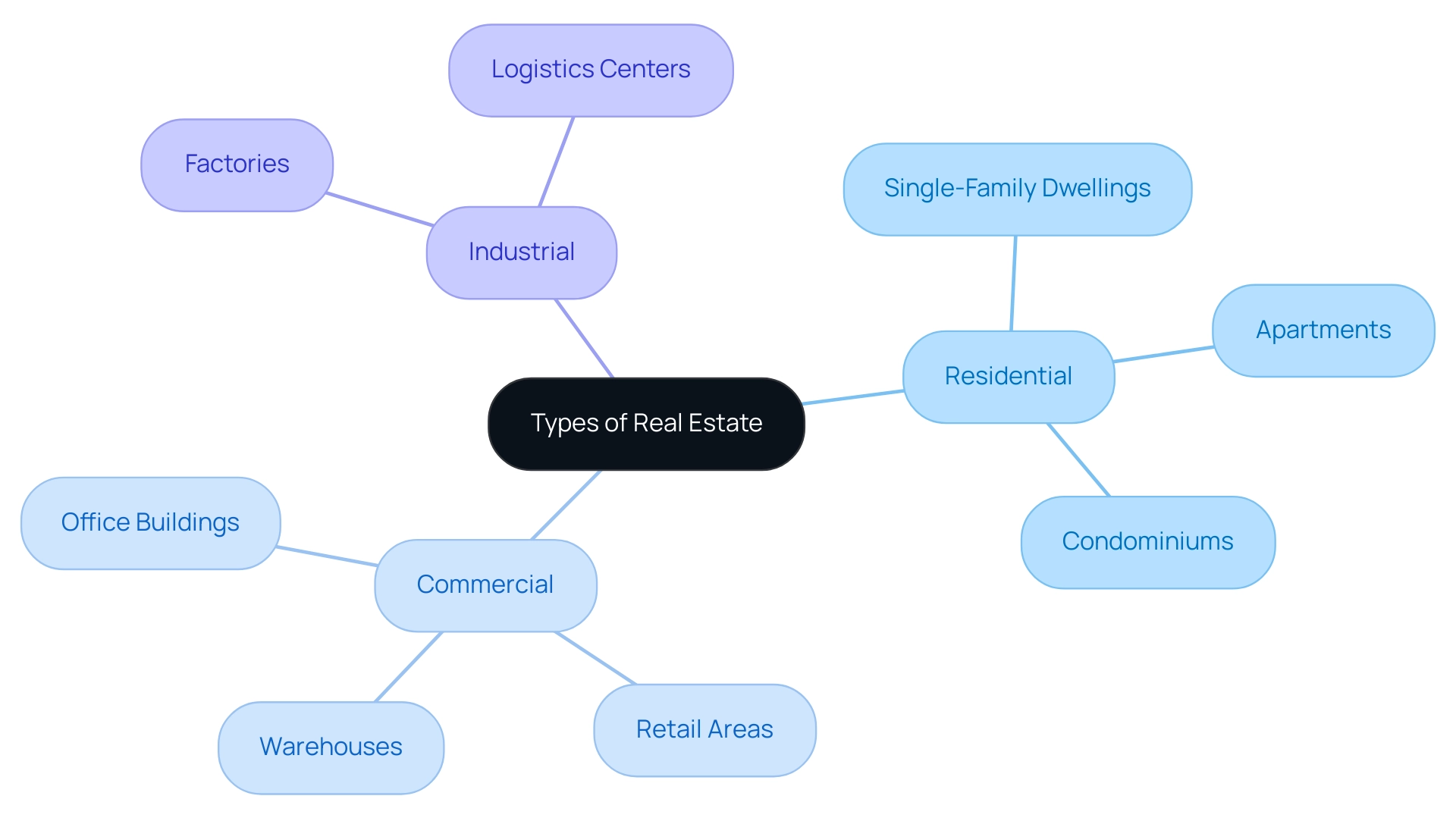

Exploring the Various Types of Real Estate

Real property is fundamentally categorized into three primary types: residential, commercial, and industrial, each with distinct characteristics and market dynamics.

Residential housing includes spaces intended for living, such as:

- single-family dwellings

- apartments

- condominiums

Commercial holdings include spaces used for business activities, which encompass:

- office buildings

- retail areas

- warehouses

Meanwhile, industrial real estate pertains to properties designated for manufacturing, production, and distribution, such as:

- factories

- logistics centers

Comprehending these categories is essential, as they offer differing financial potentials and regulatory considerations within the real estate definition. Significantly, the industrial sector has shown encouraging growth, with New Jersey experiencing the highest industrial rent rise at 9.8% year-over-year, reflective of its strong potential for capital.

Additionally, the hotel industry is seeing a 12-month occupancy rate of 62.7% as of April 2024, a decline from 66% in April 2019, underscoring the differing performance across property categories. The statement, ‘90% of millionaires are affluent due to their contributions in property,’ highlights the significance of property involvement in wealth accumulation.

Additionally, the retail sector maintains the lowest vacancy rate at 4.1%, despite facing challenges such as an 8.6% vacancy rate in malls. This resilience, despite a 12% decline in foot traffic, reflects the sector’s adaptation strategies. Insights from industry analysts emphasize the necessity for professionals in the field to grasp these distinctions, as they are pivotal for effective navigation and strategic investment within the real estate definition landscape.

The Importance of Real Estate Appraisal

The real estate definition includes the intricate process of appraisal, which determines a real estate’s value through detailed assessments of various factors, including its location, condition, and prevailing market trends. Appraisers employ several methodologies—such as the cost approach, sales comparison approach, and income approach—to arrive at a precise valuation. This evaluation is pivotal for buyers, sellers, and investors, as it directly impacts financing options, insurance costs, and tax assessments.

Notably, the integration of high-quality 3D exterior renderings into the appraisal process can significantly elevate asset value by enhancing visual appeal and market differentiation. These renderings provide an immersive experience that allows potential buyers to explore properties in a realistic manner, bridging the gap between imagination and reality. The significance of accurate appraisals cannot be overstated; they are vital for sustaining market stability and facilitating equitable transactions.

Recent findings indicate that:

- 73% of respondents express concern regarding the qualifications and training of non-appraisers, highlighting the need for expertise in this field.

- 2% of FSBO sellers found attracting potential buyers to be their most difficult task, underscoring the importance of accurate appraisals in facilitating successful transactions.

As property development evolves, the incorporation of advanced technologies, including AI-driven data analysis, is becoming progressively significant.

As Cedric Stéphane Koumetio notes,

This technological breakthrough is reinforced by AI data analysis which greatly improves decision-making by anticipating price changes through predictive modelling.

This sentiment aligns with the pressing need for appraisals to adapt to contemporary valuation methods, particularly as ownership rates continue to rise—66.1% of families owned their primary residence in 2022, according to the Federal Reserve’s Survey of Consumer Finances. Moreover, the use of drones in property has emerged as a current trend, with:

- 46% of professionals choosing to hire specialists for drone services

- 12% having someone in their office that operates drones

- 6% personally utilizing drones

This indicates a shift towards innovative appraisal techniques. In summary, the expert’s proficiency in architectural visualization, particularly through the use of detailed 3D renderings, underscores the necessity of compelling presentations to enhance appraisal outcomes and ultimately support informed decision-making in the property market. Tiny details, such as the texture of materials, the interplay of light and shadow, and the arrangement of furnishings, contribute significantly to capturing the ‘soul’ of the design.

Furthermore, these renderings can be customized to reflect various design options, allowing buyers to visualize different possibilities and tailor the space to their personal preferences.

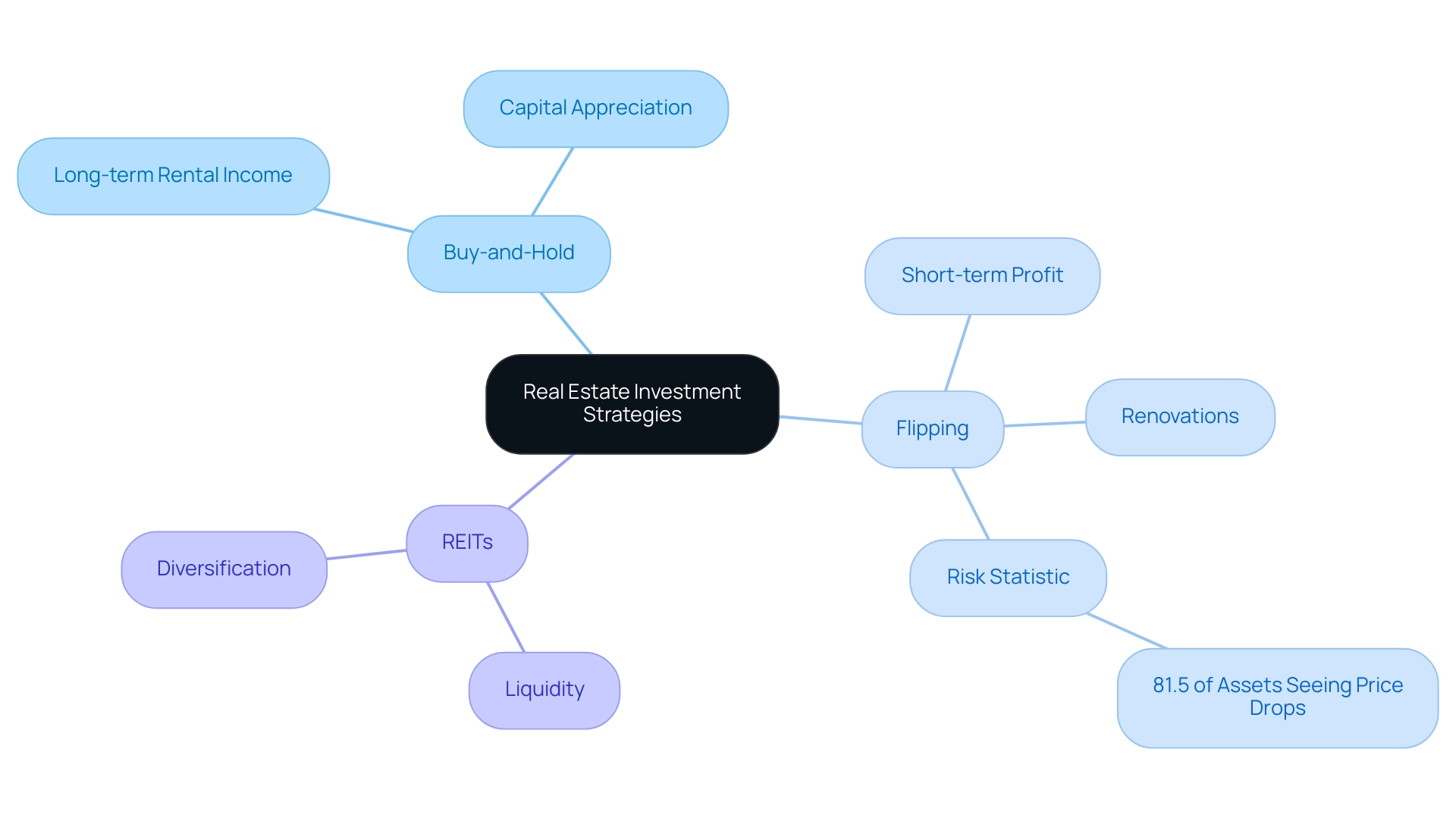

Real Estate Investment Strategies

Real estate investment strategies, according to the real estate definition, encompass a diverse array of approaches, notably including:

- Buy-and-hold

- Flipping

- Investments in real estate investment trusts (REITs)

Each strategy presents distinct advantages and challenges. The buy-and-hold strategy is marked by the acquisition of assets intended for long-term rental income, providing steady cash flow and capital appreciation over time.

Conversely, flipping requires investors to acquire real estate, undertake renovations, and subsequently sell them for profit within a shorter time frame. This method can yield significant returns but also carries inherent risks, particularly in volatile markets, as evidenced by the statistic that 81.5% of assets securing loans have seen price drops in the past 12 months. REITs offer another option, enabling investors to interact with property without the obligations of direct ownership, thereby delivering improved liquidity and diversification.

As the property environment changes, grasping the real estate definition and these tactics becomes more essential for matching funds with personal financial goals. Current trends suggest that success in the 2024 real estate market will hinge on insight, innovation, and adaptability, particularly as investors navigate the anticipated inflection point in the real estate definition of investing. Chris Brett, Head of Capital Markets (Europe), emphasizes this sentiment, noting that

investors are now underwriting that we are at the peak of the interest rate cycle and we are seeing confidence return to the investment market.

Furthermore, sustainable building practices are becoming crucial for enhancing real estate values and attracting investors, as demonstrated in a recent case study that illustrates the real estate definition within the context of these practices positively impacting property values. As strategies develop, especially with the rise of sustainable building practices that increase asset values, it is essential for investors to remain informed and adaptable in their decision-making.

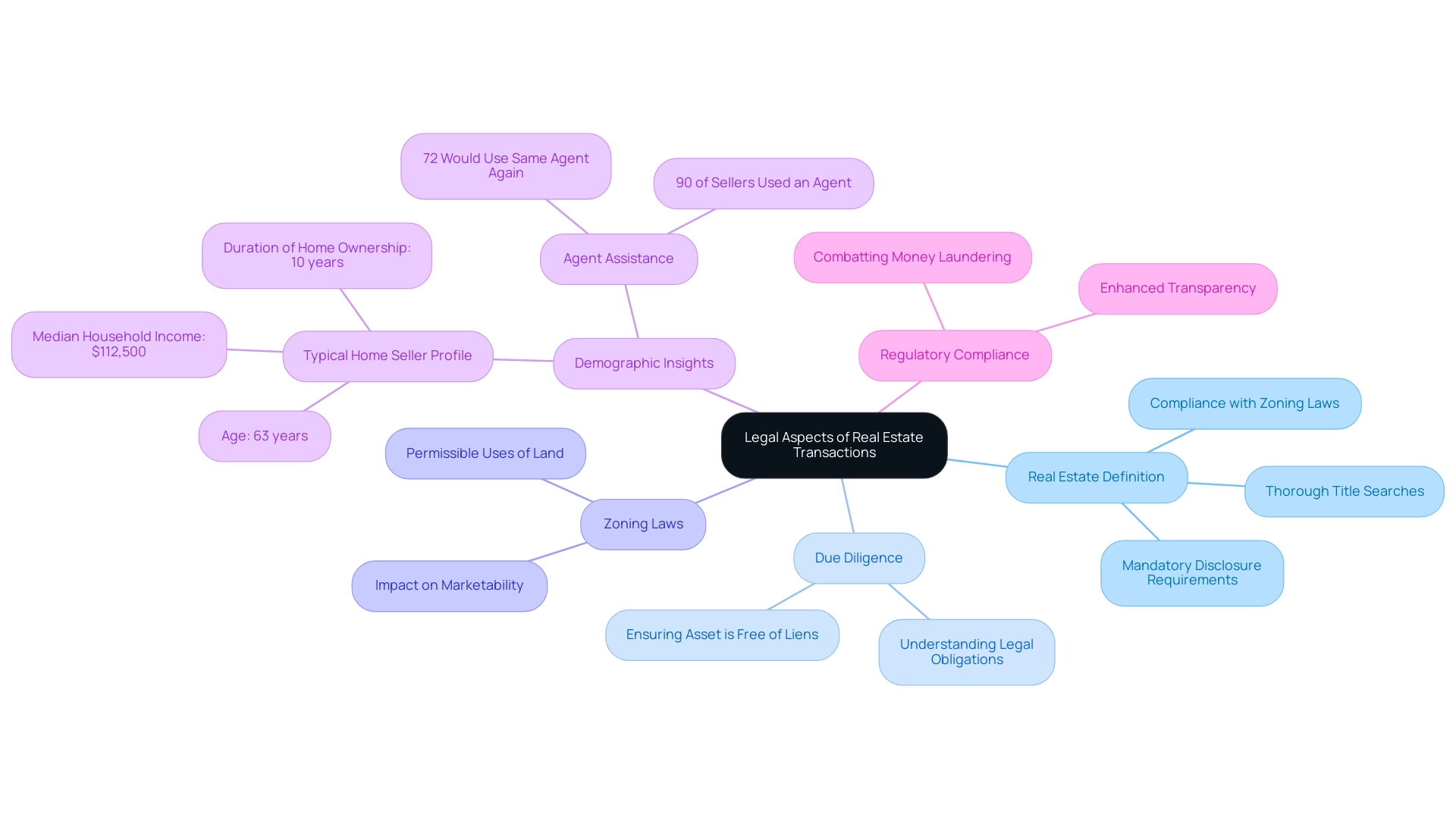

Legal Aspects of Real Estate Transactions

Navigating the legal landscape of real estate transactions requires a comprehensive understanding of the real estate definition, as well as various regulations, contracts, and statutes that govern ownership and transfer. Integral components that contribute to the real estate definition include:

- Thorough title searches

- Compliance with zoning laws

- Adherence to mandatory disclosure requirements

Performing due diligence is essential for both buyers and sellers to understand the real estate definition, as it guarantees that all legal obligations are met and that the asset is free of liens or encumbrances.

Notably, the impact of zoning laws on real estate values in 2024 highlights the real estate definition, as these regulations dictate permissible uses of land, thereby significantly influencing a real estate’s marketability and potential for development. According to the 2024 Profile of Home Buyers and Sellers, the typical home seller was 63 years old with a median household income of $112,500 and had lived in their home for 10 years. This demographic insight underscores the importance of understanding the market, which is crucial to the real estate definition when conducting due diligence.

Expert insights illustrate that compliance with architectural and zoning regulations not only affects the design and usability of a property but also its investment potential, which is crucial to understanding the real estate definition. Moreover, recent data show that 90% of sellers were helped by an agent when selling their home, highlighting the importance of understanding the real estate definition and the need for thorough due diligence.

With regulatory authorities intensifying efforts to combat money laundering in real estate, as detailed in the case study titled ‘Future Outlook for Real Estate Money Laundering Prevention,’ the real estate definition emphasizes enhanced transparency and compliance, which is expected to fortify the security and integrity of the market.

Conclusion

The complexities of real estate demand a nuanced understanding of various foundational concepts, from property classifications to investment strategies. As explored, real estate encompasses a wide array of categories, including:

- Residential

- Commercial

- Industrial properties

Each presenting unique market dynamics and investment potentials. The ongoing evolution of the real estate market in 2024 further emphasizes the necessity for stakeholders to remain informed about trends such as rising rental costs and the increasing significance of visual tools like 3D exterior renderings. These renderings not only facilitate effective communication among architects, investors, and clients but also enhance the marketing and appraisal processes, ultimately supporting informed decision-making.

Moreover, the importance of legal considerations in real estate transactions cannot be overstated. A thorough understanding of:

- Zoning laws

- Contract regulations

- The due diligence process

is essential for navigating the legal landscape effectively. As the market continues to shift, compliance with these regulations will have a direct impact on property values and investment opportunities.

In conclusion, the real estate sector requires a strategic approach that integrates knowledge of market trends, investment strategies, and legal frameworks. By leveraging quality visual tools and maintaining an acute awareness of market dynamics, stakeholders can make informed decisions that not only enhance their investment acumen but also ensure sustainable success in a rapidly evolving environment. The interplay of these factors underscores the critical importance of precision and expertise in navigating the complexities of real estate today.

0 Comments